- 05.09.2023

- Ecological justice

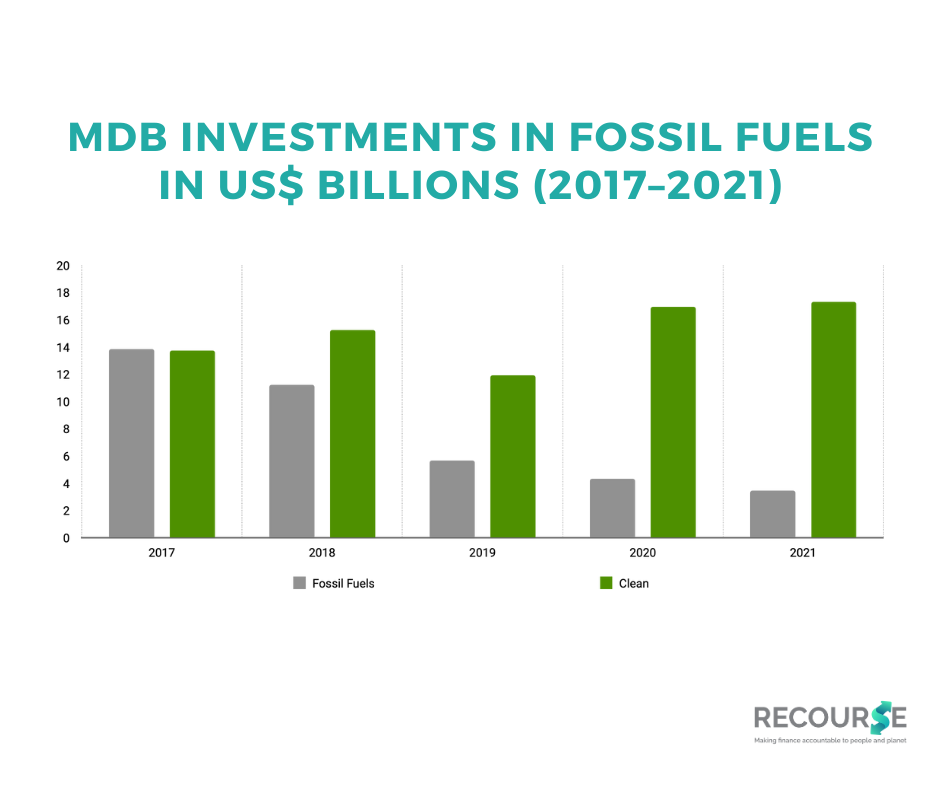

A new report by Center for Financial Accountability, Solidaritas Perempuan (SP), Sustentarse and Recourse finds that energy-related investments by Multilateral Development Banks (MDBs) since the Paris Agreement are not shifting fast enough to clean energy projects. The report analysed MDB investments in the past five years and found that despite a 75% decrease in fossil fuel investments, clean energy investments only increased a meagre 26% in the same period.

“While the decrease in fossil fuel finance is a positive trend, continued financing in oil and gas investments remains a cause for concern as these projects can lock countries into carbon-intensive development in the next 30 years – well beyond any decarbonisation target,” said Mark Moreno Pascual, Renewable Energy Campaign Manager at Recourse.

The report also looked at the World Bank’s clean energy investments and found that in the period between 2017 to 2022, the WB’s investments in clean energy show an inconsistent trend peaking at $4.8 billion in 2018 after which follows a significant 54% dip in 2019.

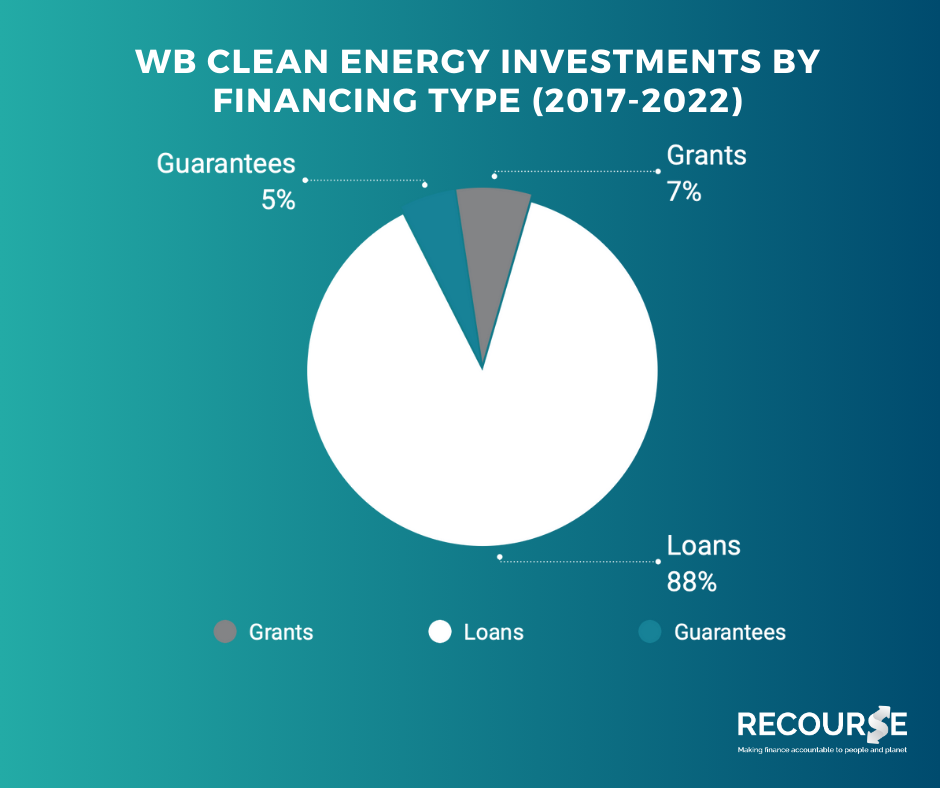

In the same period, findings demonstrate that 88% or $16.5 billion of the WB’s renewable energy financing was disbursed in the form of debt-creating loans. Only 7% or $1.3 billion was disbursed in the form of grants, while 5% or less than $1 billion in the form of guarantees.

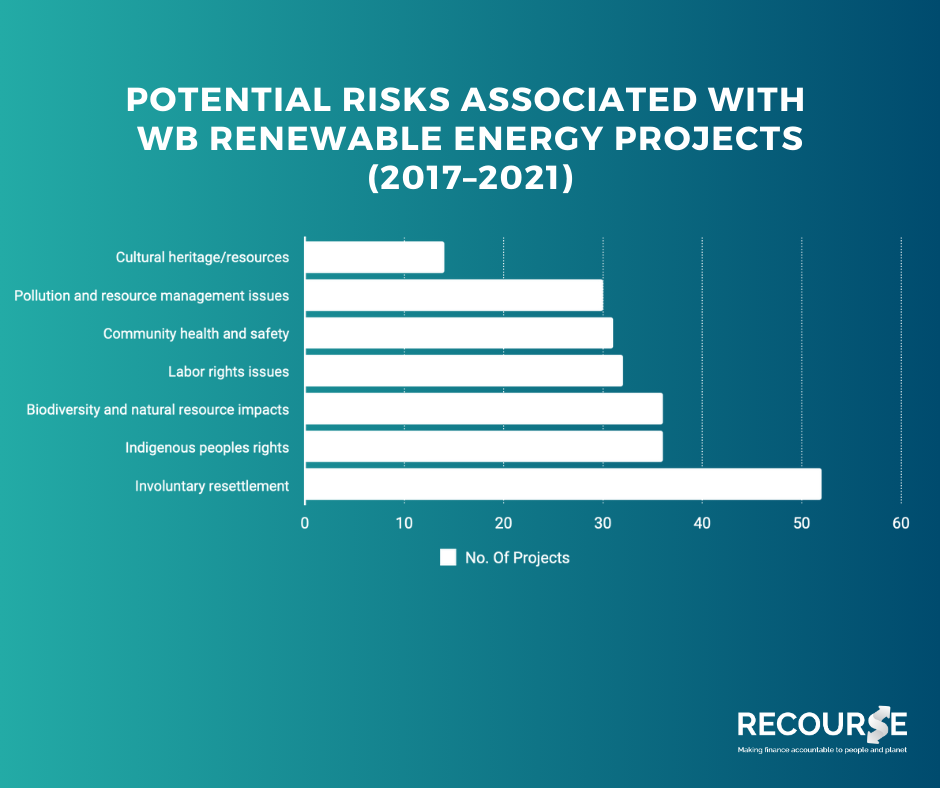

In addition, the research revealed that the WB’s clean energy investments continue to pose the same risks as in its fossil fuel projects. An analysis of project documents related to clean energy investments demonstrate that 45.6% of the WB’s clean energy investments has potential risks on land rights, mostly pertaining to cases of involuntary resettlement in the case of large-scale renewables. Meanwhile, 12.2% of the projects had potential impacts on indigenous communities, mostly requiring construction or exploration activities on indigenous lands, while 32% of projects can potentially affect cultural resources and heritage, including ancestral domains, forest and marine resources.

SP, Sustentarse and Recourse challenged the WB to ramp up their support for renewables in the form of highly concessional funding and avoid further miring developing economies deeper into debt. At the same time, the report calls for stronger safeguards to protect project-affected communities especially Indigenous Peoples, women and other vulnerable groups from land dispossession and human rights abuses.

Alongside the analysis of WB’s renewable energy portfolio, the research also comes with three case studies published together with Sustentarse, Solidaritas Perempuan, and LSD Senegal. You can read the case studies in the following links:

The ‘New Energy El Dorado?’ The World Bank’s Role in Promoting Green Hydrogen in Chile

Exploring Geothermal Energy Development in Indonesia: Policy Failures and Impacts on Women’s Rights

The Taiba N’Diaye Wind Farm in Senegal: Renewable Energy for Whom?

For more information please contact:

Maia Seeger, Sustentarse:

mseeger@sustentarse.cl

Arieska Kurniawaty, Solidaritas Perempuan:

arieska@solidaritasperempuan.org

Ndeye Fatou Sy, LSD Senegal:

n.sy@lsdsenegal.org

Anitha Sampath, Center for Financial Accountability:

anitha@cenfa.org

Mark Moreno Pascual, Recourse:

mark@re-course.org